Buying in Bonita Springs

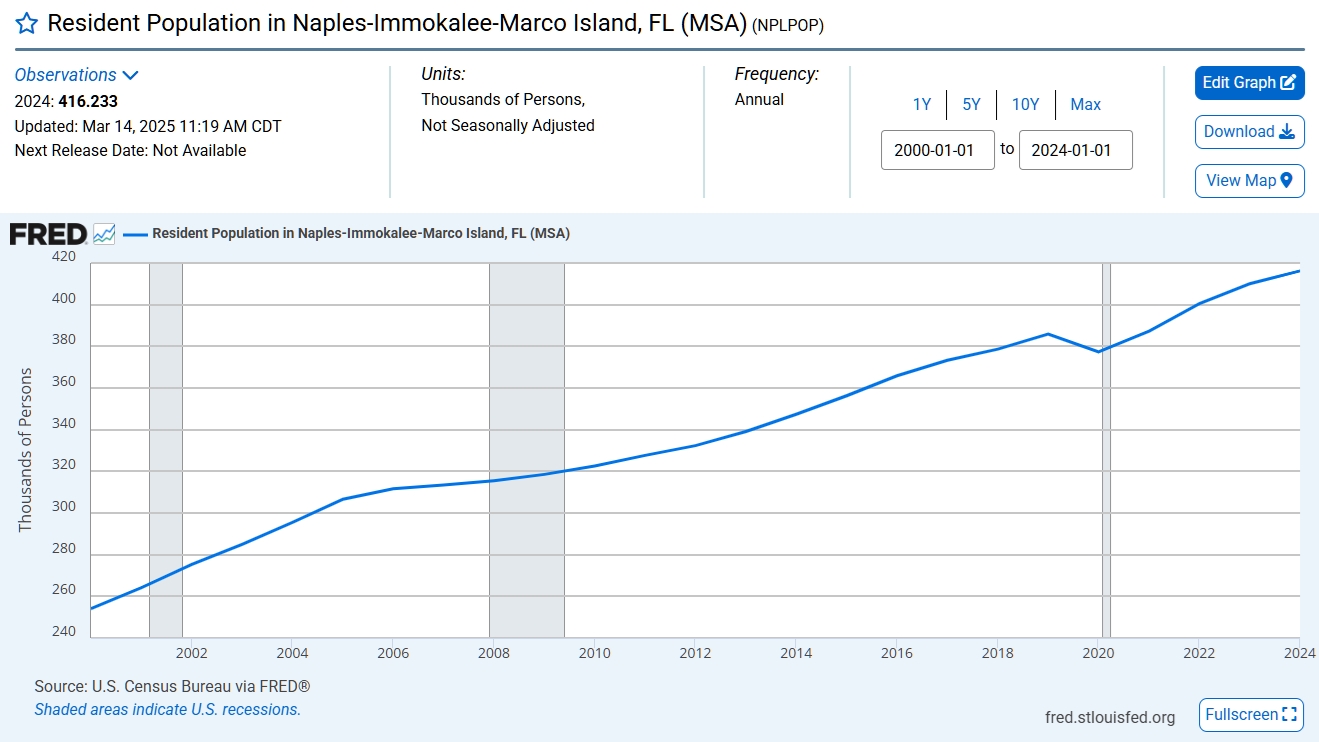

Despite the recent market cooling, Bonita Springs’ high homeownership rate (80%+) and affluent base create stability unmatched in most Florida markets. As sellers adjust to longer days on market and higher supply, we see opportunities to acquire premium single-family and waterfront homes positioned for appreciation.

The city’s median household income exceeds $90,000, with average household incomes topping $135,000. These fundamentals support strong demand for premium properties. Making it a resilient market for long-term holds.

Why Invest in the Bonita Springs Florida Area?

Leverage Buyer Conditions: Inventory up, prices down = negotiating advantage.

Upside in Stability: Affluent base and strong ownership rates support long-term value.

Clear Socioeconomic Tailwinds: Educated, wealthy, aging demographic with low turnover.

Selective Asset Targeting: Prioritize stable waterfront and value-add opportunities.

The Timing is Right

- Inventory increase and double-digit YOY price drops offer strategic buying power.

- High homeowner-occupancy with strong median property value (~$460K).

- Wealthy demographic: Median household income ~$90K, avg. ~$135K.

- Population skewed toward affluent retirees—ideal for value-driven, long-term hold strategies.

source: Redfin.com

Avg. home value (↓9% YoY)

Median sale price (↓12% YoY)

Current inventory supply

Avg. time on market

Median Age

Median listing price

Our Strategy for Hedge Fund Acquisition

Acquire single-family and waterfront assets with long-term appeal.

Leverage local intelligence and analytics to identify off-market deals.

Reposition, optimize, and hold for 8–10% IRR over 3–5 years.

The section below has been added for the homeowner only.

Your Market Data

ALTERNATIVE SOLUTION: Marketing the Property

Provided the opportunity, we are often engaged to list properties for investors and typical homeowners. If our buyer is not a match for your property, we are able to provide a White Glove full-service real estate program.

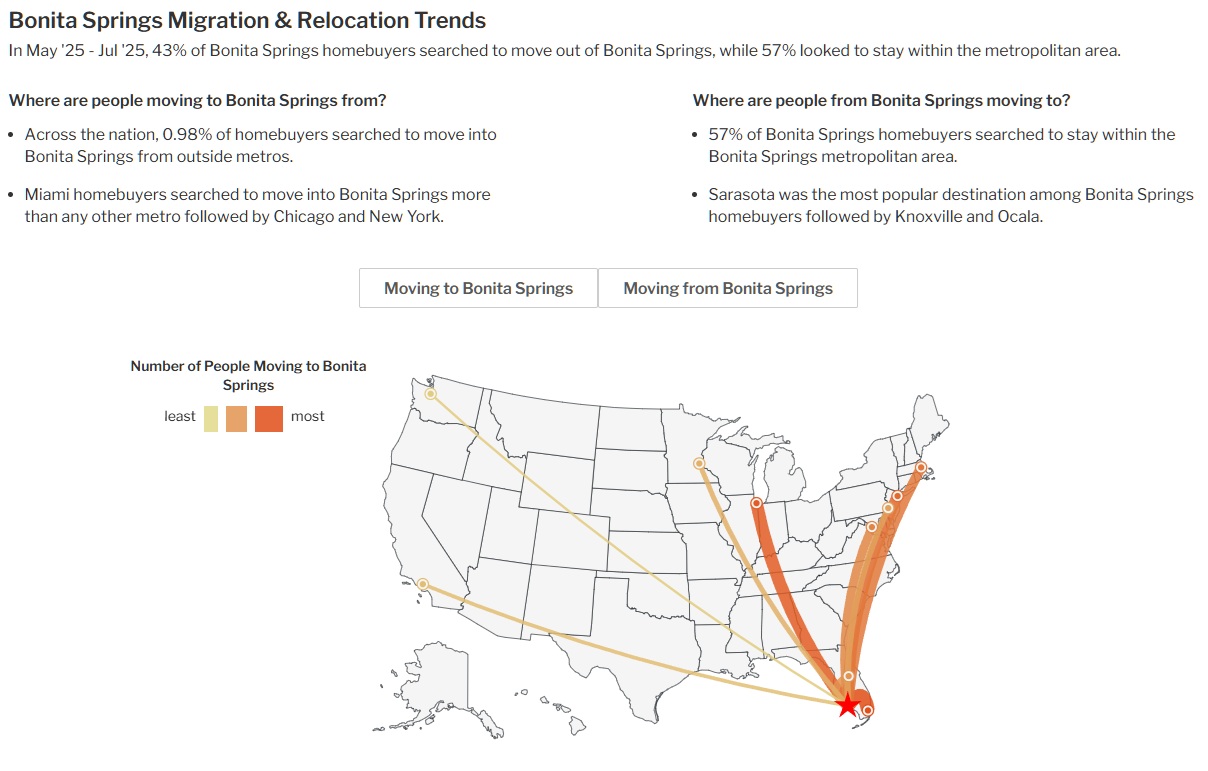

- National and international networking and marketing

- Negotiation skills

- Corporate relocation network

Why Resetting Your Days on Market Matters.

In today’s MLS, the number of “days on market” sends a strong signal to buyers. A property that lingers with a high DOM count often makes buyers wonder what’s wrong with it, even if there’s nothing at all.

By resetting your days on market, we present your home as a fresh new opportunity and remove the negative perception of being “stale.” This simple reset can attract more interest, stronger offers, and a faster sale.

Understanding the Protection Period.

Many listing agreements include a short “protection period” after expiration, which only applies to buyers the agent personally brought to your property. If your listing has expired and you’re still within that protection period, you do not owe your previous agent anything if we step in after the fact.

We bring new opportunities and new buyers, which means you’re free to work with us without any obligation to your past agreement.